9 Essential Forex Propfirm Tips for Success in 2026

Unlock forex propfirm success in 2026 with 9 expert tips on risk management, technology, firm selection, and growth strategies for lasting trading results.

Jan 9, 2026

The world of forex propfirm trading is transforming quickly as 2026 approaches. With new technologies, tighter regulations, and more competitors entering the market, traders must adapt to succeed.

Today, an increasing number of individuals are choosing a forex propfirm to gain access to larger trading capital and advanced tools. However, thriving in this environment takes more than just technical skills.

What separates top performers from the rest? In this guide, you will discover nine essential tips that leading traders use to stay ahead in the evolving forex propfirm industry. Get ready to learn practical strategies, effective risk management, and valuable insights to help you excel with forex prop firms in 2026.

Understanding the 2026 Forex Prop Firm Environment

As 2026 approaches, the forex propfirm landscape is undergoing unprecedented transformation. Traders must stay informed about regulatory shifts, technological innovations, and evolving expectations to remain competitive. Let us explore the four core areas shaping the future of forex propfirm operations.

Shifting Regulatory Landscape and Compliance

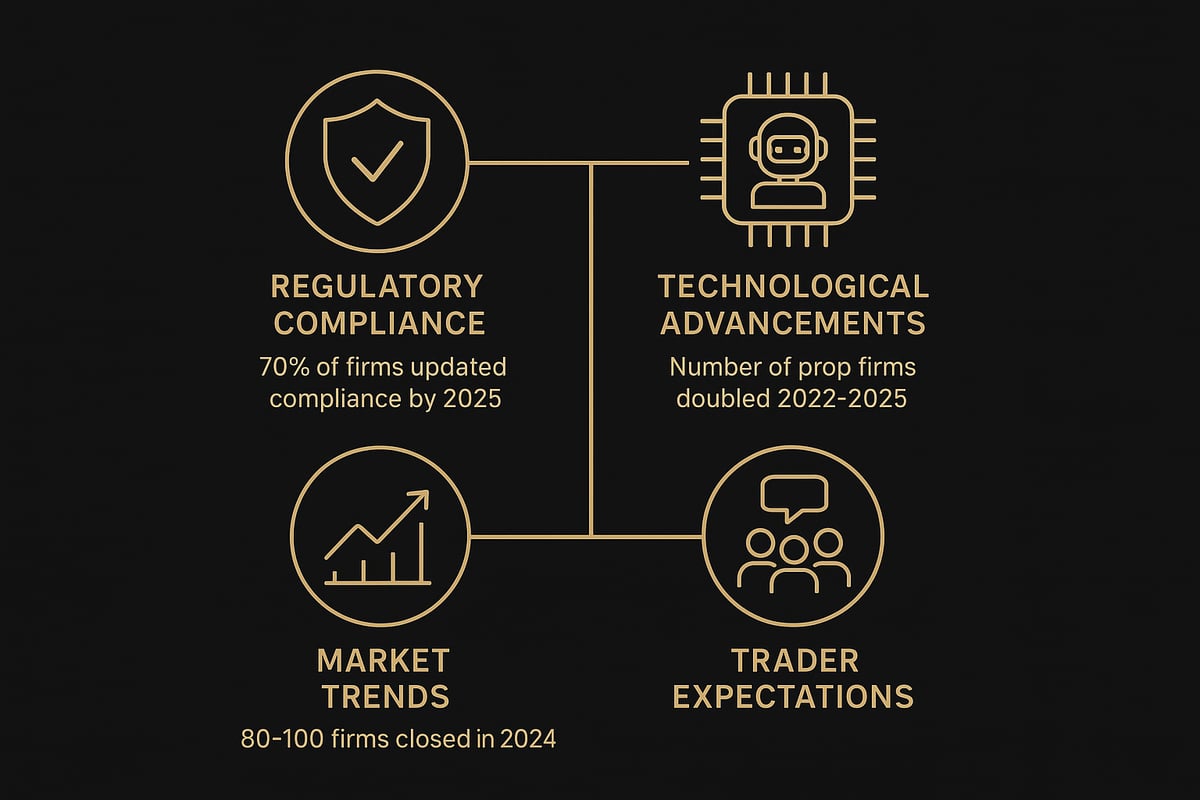

The global regulatory environment for forex propfirm operations is tightening. Authorities now demand robust KYC and AML procedures, driving firms to adopt more transparent reporting standards.

Recent updates, such as those by ESMA, have reduced leverage limits and forced prop firms to revise account structures and payout models. These changes are not just regional; they affect global forex propfirm strategies. According to a 2025 survey, over 70% of firms reported updating their compliance protocols to meet new requirements.

Traders must understand how these regulations impact their access to capital and the structure of their trading accounts. Staying compliant is now essential for long-term success with any forex propfirm.

Technological Advancements in Prop Trading

Technology is revolutionizing the way forex propfirm traders operate. Artificial intelligence, automation, and advanced data analytics have become standard tools. Firms now rely on proprietary risk management systems and performance dashboards to evaluate and scale traders efficiently.

Automated trade verification and instant funding models are making the evaluation process faster and more accurate. For example, automated systems can detect rule breaches instantly, reducing disputes and improving transparency.

These advancements mean that joining a forex propfirm in 2026 requires not just trading skill, but also a strong grasp of the latest digital tools. Those who adapt quickly will benefit from more efficient funding and evaluation opportunities.

Market Trends and Competitive Dynamics

The number of forex propfirm companies and trader applicants has grown rapidly in recent years. Competition for funding is fierce, and evaluation standards are higher than ever. Unique offerings like attractive profit splits and instant payouts are now expected.

According to industry data, the number of prop firms doubled between 2022 and 2025. However, this growth came with significant consolidation. In 2024, between 80 and 100 firms closed due to market pressures, as highlighted in this analysis of prop trading industry consolidation in 2024.

For traders, choosing a forex propfirm with a strong track record and competitive conditions is crucial. The market now favors firms that are both innovative and stable.

Evolving Trader Expectations

Trader expectations from a forex propfirm have changed dramatically. Today’s traders seek transparency, fast payouts, and flexible trading conditions. Community support, educational resources, and social trading platforms like Discord have become key differentiators.

Many forex propfirm companies now offer interactive communities and mentorship programs, which help traders share strategies and stay motivated. The demand for real-time support and up-to-date resources continues to grow.

To succeed in 2026, traders should align with a forex propfirm that prioritizes both professional development and community engagement.

9 Essential Forex Propfirm Tips for Success in 2026

Navigating the forex propfirm landscape in 2026 requires more than just sharp trading skills. The industry now demands a blend of adaptability, discipline, and strategic planning to consistently succeed. Below, discover nine essential tips that leading traders use to thrive in the evolving world of forex propfirm trading.

1. Master the Evaluation Process

Every forex propfirm has its own evaluation process, and mastering it is crucial. Whether you are facing a one-step, two-step, or instant funding challenge, understanding the rules is non-negotiable. Many traders underestimate the complexity of these evaluations, leading to avoidable mistakes.

You should always read the guidelines in detail and know the difference between evaluation models. For example, some forex propfirm challenges focus on consistency, while others prioritize profitability or risk control. Make use of demo accounts and mock challenges to build confidence.

A common pitfall involves breaching daily loss limits or violating specific trading rules. In fact, over 60% of evaluation failures are attributed to rule violations. To avoid this, consider reviewing Forex Prop Firm Evaluation Types to get familiar with the typical structures and requirements.

Preparation is everything. Aim to simulate real trading conditions and practice until the process feels routine. By mastering the evaluation process, you set the foundation for long-term forex propfirm success.

2. Prioritize Robust Risk Management

Risk management is the backbone of every successful forex propfirm trader. Setting realistic daily and overall drawdown limits protects your account from devastating losses. Industry standards recommend risking only 1–2% per trade, which helps you withstand inevitable market swings.

Proper use of stop-loss orders and careful position sizing are critical. Traders who consistently apply strict risk management not only pass evaluations at double the rate but also enjoy more stable long-term performance in any forex propfirm environment.

Leverage risk calculators and maintain a detailed trading journal. This habit reveals patterns and highlights areas for improvement. By prioritizing risk, you safeguard your capital and maintain the flexibility to adapt to any challenge the forex propfirm industry presents.

3. Leverage Technology and Automation

The modern forex propfirm landscape is powered by technology. Automated trade management platforms and AI-driven analysis tools have become essential for competitive traders. These innovations streamline trade execution, provide instant alerts, and reduce the likelihood of costly errors.

Proprietary dashboards offered by many forex propfirm companies allow you to track your performance in real time. Automated trade verification, for instance, can resolve disputes quickly and ensure compliance with firm rules.

AI-based pattern recognition tools can help identify high-probability setups, giving you an edge. Embracing these technologies not only boosts efficiency but also demonstrates your ability to adapt to the evolving demands of forex propfirm trading in 2026.

4. Choose the Right Prop Firm for Your Needs

Not all forex propfirm companies are created equal. When selecting a firm, compare profit splits, payout speeds, and funding scalability. Some firms offer up to 95% profit splits, which can significantly impact your earnings.

Platform compatibility is also vital. Make sure your preferred trading software, such as MT4, MT5, or cTrader, is supported. Transparency matters, so review the firm’s rules and fee structures carefully before committing.

Community support and educational resources are key differentiators. Top forex propfirm companies foster a supportive environment, helping traders grow. By choosing the right partner, you position yourself for long-term success and satisfaction.

5. Develop a Disciplined Trading Strategy

A disciplined strategy is what separates successful forex propfirm traders from impulsive ones. Start by creating a detailed trading plan that outlines your approach, risk limits, and profit targets. Stick to your plan, even during periods of volatility.

Adapt your strategy to meet each forex propfirm’s unique conditions, such as drawdown restrictions or lot size limits. Backtest your strategy using historical data, then forward-test in a demo environment to ensure consistency.

Consistent traders outperform impulsive ones by 30%. By maintaining discipline and refining your approach, you build a track record that qualifies you for larger accounts and greater profit splits within the forex propfirm ecosystem.

6. Adapt to Changing Market Conditions

The forex propfirm world is shaped by shifting market dynamics. Successful traders monitor macroeconomic events, news releases, and volatility spikes to adjust their strategies. Flexibility is key during high-impact news, as liquidity and spreads can change rapidly.

Adjust your trading times, pairs, and risk exposure based on current conditions. In 2025, for example, USD volatility tested many traders’ adaptability. Those who adjusted their strategies managed to preserve capital and capitalize on new opportunities.

Being able to pivot quickly is a hallmark of a top forex propfirm trader. Stay alert and be ready to modify your approach as the market evolves.

7. Utilize Educational Resources and Mentorship

Continuous learning is vital for forex propfirm traders. Many firms offer webinars, courses, and mentorship programs designed to boost your skills. Take advantage of these resources to stay ahead.

Joining trader communities provides peer feedback and fresh perspectives. Mentorship programs have been shown to increase pass rates by 20%, highlighting the value of learning from experienced traders within the forex propfirm industry.

Stay updated with industry news, and participate in community events or forums. This proactive approach to education will keep your skills sharp and your strategies relevant.

8. Maintain Psychological Resilience

Trading for a forex propfirm can be mentally demanding. Managing stress, coping with losses, and staying disciplined during emotional swings are all part of the job. Psychological resilience is often cited as the main challenge by 40% of traders.

Incorporate techniques like journaling, meditation, or scheduled breaks into your routine. These strategies improve focus and help you reset after challenging sessions. Reflect on both wins and losses to develop a balanced mindset.

Building mental strength is as important as technical analysis. A resilient trader is better equipped to handle the ups and downs of the forex propfirm journey.

9. Plan for Scaling and Long-Term Growth

Think beyond your initial account when working with a forex propfirm. Top traders set milestones for increasing account size and profit share. Gradually scale up by diversifying trading approaches and funding sources.

Regularly review your progress and adjust your strategy as needed. Many successful forex propfirm traders have scaled from $10,000 to $200,000 in under a year by following a structured growth plan.

Set realistic goals and celebrate milestones along the way. Long-term growth is about steady progress, consistent review, and adapting to the changing forex propfirm landscape.

How to Identify a Reliable Forex Prop Firm in 2026

Choosing the right forex propfirm in 2026 is more important than ever. With a rapidly growing market and evolving regulations, traders must be diligent when evaluating firms for transparency, support, and credibility. Understanding what sets a trustworthy forex propfirm apart can help you avoid costly mistakes and focus on building a successful trading career.

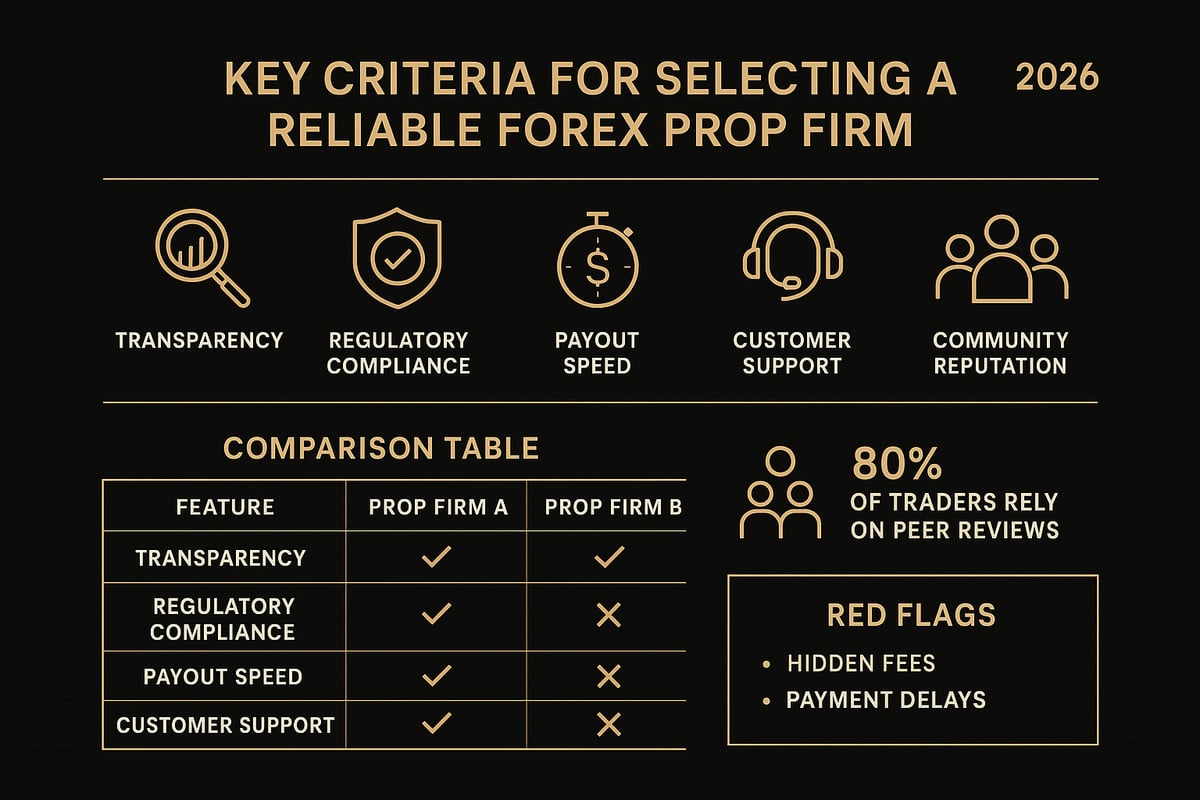

Key Criteria for Trustworthy Prop Firms

Transparency is the foundation of any reliable forex propfirm. Look for clear, publicly available rules, straightforward fee structures, and published performance statistics. Regulatory compliance is essential, as it protects your interests and ensures fair trading conditions. A reputable forex propfirm will have a strong standing in the trading community, with a solid track record and positive feedback.

Speed and reliability of payouts are other crucial factors. Make sure the profit split model is easy to understand and that payment schedules are clearly outlined. Be alert for red flags, such as unrealistic profit promises, hidden fees, or slow customer support responses. Firms that are slow to respond or have vague terms should be approached with caution.

To further protect yourself, familiarize yourself with standardized requirements and typical trading limitations by reviewing resources like Trading Rules and Restrictions Explained. This knowledge helps you spot inconsistencies or questionable practices before you commit to a specific forex propfirm.

Evaluating Firm Features and Support

A top-tier forex propfirm will offer demo accounts or trial challenges, allowing you to test their systems and your strategies risk-free. The depth of educational resources is another indicator of a quality firm. Webinars, tutorials, and active trading communities show that a company invests in its traders' long-term growth.

Customer support is equally important. Responsive, knowledgeable support teams can address concerns quickly, making your trading experience smoother. Compare firms based on the quality and availability of their educational materials and community engagement. Well-established firms often provide more robust support networks, while newer firms may offer unique incentives but lack comprehensive resources.

Consider the trading platforms supported, the flexibility of trading conditions, and the ease of access to account information. When evaluating multiple options, use a comparison table to weigh features side by side. This approach helps you focus on what matters most for your trading style and ensures you select a forex propfirm aligned with your goals.

Feature | Top-Rated Firm | Emerging Firm |

|---|---|---|

Demo Account | Yes | Sometimes |

Education Resources | Extensive | Limited |

Payout Speed | Fast | Variable |

Community Support | Strong | Growing |

Real Trader Experiences and Reviews

Real-world feedback is invaluable when selecting a forex propfirm. Third-party review sites and trader testimonials provide insight into actual payout reliability, support quality, and overall satisfaction. Success stories and cautionary tales from 2025 and 2026 can highlight both opportunities and potential pitfalls.

Peer reviews are especially important, as 80% of traders now rely on them before making a decision. Look for consistent patterns in reviews, such as praise for transparent rules or frequent complaints about delayed payments. Case studies and detailed feedback can reveal how a forex propfirm handles challenges like high volatility or technical issues.

For a comprehensive overview of the most reputable options, consult independent rankings like Top forex prop firms in 2025. These resources evaluate firms on funding stability, transparency, and trader-first conditions, giving you a head start in your search. By leveraging community insights and trusted comparisons, you can confidently choose a forex propfirm that supports your trading ambitions.

The Role of Community, Networking, and Ongoing Learning

A thriving forex propfirm journey extends beyond charts and trades. Top performers recognize that building relationships, sharing insights, and embracing continuous learning are critical to long-term success. As the industry evolves, community and networking have become essential pillars for every trader aiming to excel.

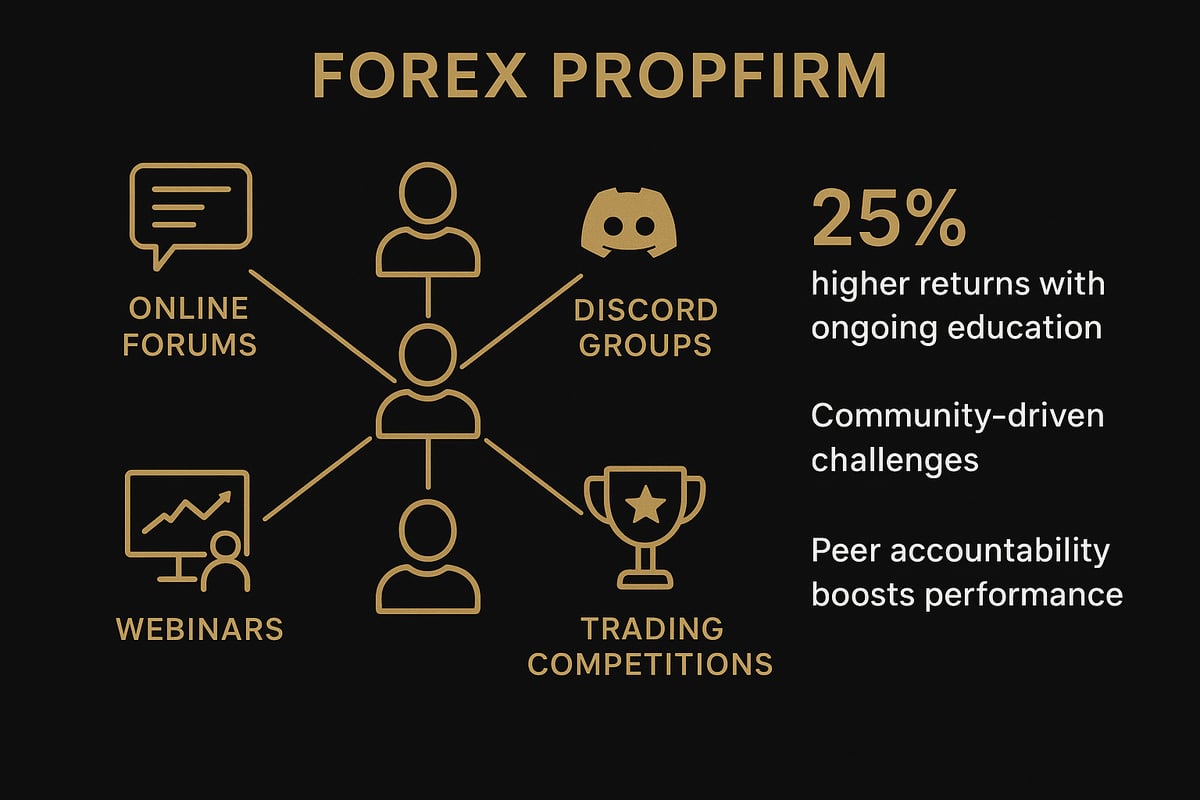

Building a Supportive Trading Network

Engaging with a forex propfirm community offers more than camaraderie. It provides vital peer accountability and a platform for sharing real trading experiences. Joining online forums, Discord groups, and dedicated prop firm communities can accelerate your growth by connecting you with traders facing similar challenges.

Collaborative spaces often host community challenges and trading competitions. These events foster healthy competition and open doors to new strategies. Through regular interaction, traders in a forex propfirm environment exchange market insights, build lasting professional relationships, and support each other's progress.

Continuous Education and Skill Development

Staying ahead in the forex propfirm landscape requires a commitment to lifelong learning. Top traders regularly participate in webinars, listen to industry podcasts, and enroll in trading courses to refine their skills. Keeping up with the latest strategies and market updates is essential for maintaining an edge.

Leveraging educational resources, such as risk management guides or expert-led workshops, not only sharpens your technical skills but also strengthens your confidence. For example, referencing Risk Management Guidelines for Traders can help you internalize best practices that set consistent performers apart. Continuous education directly correlates with higher returns and more resilient trading habits in the forex propfirm world.

Sharing and Learning from Experiences

Transparency is vital for growth within any forex propfirm ecosystem. Sharing both successes and setbacks allows traders to learn from real-world scenarios, refine strategies, and avoid repeating mistakes. Community-driven initiatives, like open discussions or case studies, provide practical insights that books alone cannot offer.

Collaborative problem-solving is a hallmark of strong trading communities. By exchanging feedback and reviewing each other's trades, members of a forex propfirm network can collectively improve their performance. This culture of openness encourages innovation and continual improvement for traders at every level.

As we look ahead to 2026, embracing technology, sound risk management, and a growth mindset is more important than ever for forex prop firm success. You’ve explored key strategies, from choosing the right firm to leveraging automation and building your trading network. If you’re ready to put these tips into action and access professional tools, instant funding, and up to a 95% profit split in a supportive, transparent environment, now is the perfect time to take the next step. Let’s turn your trading goals into reality—Get Funded.

Article written using RankPill.