Prop Firm Competition Guide: Master the 2026 Trading Scene

Master the 2026 prop firm competition scene with expert strategies, trend analysis, and technology insights to maximize your trading success and secure funding.

Jan 8, 2026

The world of prop firm competition is exploding, with more traders than ever chasing record payouts and elite status in 2026. As opportunities grow, so does the challenge, making it crucial to stand out in a rapidly evolving landscape.

This guide is your roadmap to navigating and mastering prop firm competition this year. You will discover what these competitions are, the latest industry trends, winning strategies, common pitfalls, and how to leverage technology and community for a real edge. Ready to unlock actionable insights and take your trading career to the next level? Dive in and get started.

Understanding Prop Firm Competitions in 2026

The prop firm competition landscape in 2026 is rapidly evolving, offering more opportunities and challenges for traders than ever before. Whether you are a newcomer or a seasoned trader, understanding the structure and dynamics of a prop firm competition is crucial for maximizing your success and securing funding. Let’s break down the essential elements that define these competitions and how they shape the trading industry.

What Are Prop Firm Competitions?

A prop firm competition is a simulated trading contest hosted by proprietary trading firms. These events are designed to identify top trading talent and reward high performers with funded accounts or other incentives. Most competitions feature daily, weekly, monthly, or special one-off formats, attracting thousands of participants globally.

For example, The5ers hosts free-entry weekly contests where the top 100 traders receive prizes, with some events drawing over 20,000 participants. Competitions are typically run on demo accounts, though some firms also offer live trading events. The main goal is to discover skilled traders and help them advance their careers. For a comprehensive analysis of how these competitions work, see Prop Firm Competitions Explained.

Major Types of Prop Firm Challenges

There are several types of prop firm competition challenges, each with unique structures and requirements. The most common models include 1-step, 2-step, 3-step, and instant funding challenges. Each format varies in terms of risk, potential rewards, and evaluation criteria.

For instance, The5ers’ HyperGrowth is a 1-step challenge, while HighStakes uses a 2-step process, and Bootcamp follows a 3-step evaluation. Instant funding models allow experienced traders to bypass evaluations by submitting a verified track record. Profit splits can reach up to 95 percent, and entry requirements range from free to paid. Understanding these formats is key to selecting the right prop firm competition for your goals.

Challenge Type | Steps | Example | Entry | Profit Split | Evaluation |

|---|---|---|---|---|---|

1-Step | 1 | HyperGrowth | Paid | Up to 95% | Simple |

2-Step | 2 | HighStakes | Paid | Up to 90% | Moderate |

3-Step | 3 | Bootcamp | Paid | Up to 85% | Rigorous |

Instant | 0 | Instant Funding | Free | Up to 95% | Record |

Key Rules and Metrics for Success

Each prop firm competition is governed by strict rules and metrics to ensure fair play and risk management. Common rules include maximum drawdown limits, daily loss thresholds, leverage caps (such as 1:30), and position limits. Metrics tracked often include total profit and loss, win rate, best winning trade, and number of trades executed.

Leaderboards provide real-time tracking of trader performance. For example, The5ers enforces a 5 percent daily loss and 10 percent overall loss, with no use of expert advisors and a starting balance of $10,000. Consistency and solid risk management are vital, as breaking rules can lead to disqualification. These requirements shape trading behavior and determine who advances in the prop firm competition.

Prize Structures and Incentives

The prize structure in a prop firm competition can be highly motivating. Winners often receive funded accounts, cash bonuses, certificates, platform credits, or merchandise. For instance, The5ers awards the top winner a $60,000 High Stakes account, with over 90 additional prizes for other high performers.

Competitions may run daily, weekly, or monthly, ensuring frequent opportunities for traders. The wide distribution of rewards, including secondary and consolation prizes, encourages broad participation. Some firms offer over 100 prizes per contest. Building a track record through these events can unlock long-term benefits and create stepping stones for a professional trading career.

The Role of Community and Support

A strong community and robust support system are essential features of modern prop firm competitions. Firms foster engagement through Discord channels, webinars, live events, and knowledge bases, allowing traders to learn, share strategies, and network.

Atlas Funding, for example, offers 24/7 support and an active Discord community where traders exchange ideas and seek mentorship. Educational resources, including blogs and academies, help participants improve their skills. Networking within these communities often leads to collaboration, motivation, and valuable opportunities, making the community aspect a cornerstone of success in every prop firm competition.

2026 Trends Shaping Prop Firm Competition

The landscape of prop firm competition is evolving rapidly in 2026. New models, technology, and global access are driving record participation and changing how traders pursue funding. Staying ahead of these trends is crucial for anyone aiming to win in the fierce prop firm competition arena.

Rise of Instant Funding and Flexible Assessments

Instant funding has become a game changer in prop firm competition. Firms now offer pathways for experienced traders to upload a verified track record, skipping lengthy evaluations. For example, Aeon Funded’s instant funding model lets qualified traders access simulated capital with just a 3 month record.

This trend lowers barriers and makes prop firm competition more accessible. More traders are joining, knowing they can prove themselves and earn funding quickly. Firms are responding with stricter verification tools to ensure fairness and prevent abuse, keeping the competition credible.

Flexible assessments also attract a broader range of participants. With multiple challenge formats, traders can pick what aligns with their strengths and career goals.

Increasing Profit Splits and Faster Payouts

In 2026, prop firm competition is marked by generous profit splits and ultra fast payouts. Some firms now offer up to 95 percent profit share, giving traders a bigger incentive to compete at their best.

Weekly, and even 24 hour, payout options are replacing traditional monthly cycles. Atlas Funding and Aeon Funded are leaders in this area, offering rapid profit access for top performers. This motivates traders to push harder and builds trust in the prop firm competition space.

Higher splits and faster payouts also attract more skilled traders, raising the overall quality and intensity of competitions.

Automation, Technology, and Real-Time Evaluation

Automation and advanced technology are redefining prop firm competition. Tools like Smart Trade Scanner and dual book engines automate performance checks and seamless account transitions. Traders can now see real time stats, compliance alerts, and leaderboard movements on user friendly dashboards.

Aeon Funded’s Smart Trade Scanner, for example, gives instant feedback, helping traders adjust their strategies on the fly. This reduces manual errors and creates a level playing field.

Technology adoption is rising across the industry, with firms leveraging AI and real time analytics to enhance the competition experience. For a deeper look at how AI and gamification have shaped these changes, see the Prop Firm Industry Recap 2025.

Low Entry Barriers and Global Accessibility

Prop firm competition has become more global than ever. Lower entry fees, sometimes as little as five dollars, and free weekly contests mean anyone can participate, regardless of location or capital.

The5ers offer free entry contests, while Atlas Funding provides low fee challenges. This inclusivity has led to a surge in participants from emerging markets, making prop firm competition more diverse.

Firms are also expanding into multiple asset classes, like forex, stocks, and futures, which increases accessibility and allows traders to compete in their preferred markets.

Community-Driven Learning and Networking

Community engagement is now central to prop firm competition. Discord groups, webinars, and live events connect traders, providing spaces to share strategies and support.

Atlas Funding’s Discord and The5ers’ educational resources help traders learn from each other and stay motivated. Peer mentorship and networking have become valuable tools for improving performance.

A strong community not only boosts retention but also helps traders build relationships that can shape their long term trading careers in prop firm competition.

Aeon Funded: Technology-Driven Evaluation and Instant Funding

Aeon Funded stands out in prop firm competition by combining advanced automation with flexible funding paths. Traders can select from 1 step, 2 step, 3 step, or instant funding challenges, with simulated accounts up to 400,000 dollars.

The Smart Trade Scanner and dual book engine ensure real time performance verification and seamless account upgrades. With up to 95 percent profit split, 24 hour simulated payouts, and unlimited trading days, Aeon Funded removes common obstacles and hidden rules.

Traders with a 3 month verified track record can access instant funding up to 200,000 dollars. Active Discord support and educational resources foster skill development and community, making Aeon Funded ideal for those seeking a transparent, tech driven prop firm competition experience.

Step-by-Step Strategy: How to Win a Prop Firm Competition in 2026

Success in a prop firm competition requires more than just trading skill. You need a strategic, disciplined approach that covers everything from preparation to community engagement. This step-by-step guide breaks down exactly how to position yourself for a winning performance in 2026.

Step 1: Research and Choose the Right Competition

Your journey in the prop firm competition world starts with smart research. Not all competitions are created equal. Compare options based on your trading style and preferred assets, such as forex, stocks, or futures.

Look at entry fees, prize structures, and profit splits. Some firms offer over 100 prizes weekly, while others focus on larger single payouts. Evaluate rules around drawdown, leverage, and position limits. Firm reputation, payout speed, and the strength of the trader community also matter.

Here’s a quick comparison table to help:

Feature | The5ers Weekly | Atlas Funding | Other Firms |

|---|---|---|---|

Entry Fee | Free | Low | Varies |

Prizes | 100+ | Flexible | Fewer |

Profit Split | Up to 90% | Up to 95% | 80–90% |

Align your prop firm competition choice with your long-term goals and skill set. The right match sets the stage for success.

Step 2: Understand and Internalize the Rules

Every prop firm competition comes with a detailed set of rules. Ignoring these can lead to instant disqualification, even if your trading is profitable. Carefully review guidelines about position limits, leverage, news trading, and prohibited strategies. For example, some competitions ban EAs or copy trading and enforce strict daily loss limits.

Set up alerts for approaching drawdowns or max loss thresholds. Use checklists to track compliance and avoid common mistakes. If anything is unclear, contact support for clarification. For a comprehensive breakdown, see the Prop firm trading rules explained page.

Mastering the rulebook is as important as mastering your trading strategy. It’s the foundation for consistent performance and advancement in any prop firm competition.

Step 3: Develop a Consistent, Risk-Managed Trading Plan

A successful prop firm competition run relies on consistency and risk control. Design a trading plan that fits the contest’s specific constraints. Focus on position sizing, stop losses, and controlling drawdown.

Avoid aggressive risks in pursuit of leaderboard glory. Top traders typically maintain high win rates with low drawdowns. Backtest your strategy in demo environments to ensure it aligns with real competition conditions.

Keep a detailed trading journal. Document your results and adjust your plan as needed. By prioritizing discipline and risk management, you build a foundation for repeatable success in any prop firm competition.

Step 4: Leverage Technology and Real-Time Analytics

Technology gives you a competitive edge in today’s prop firm competition landscape. Use firm-provided dashboards to monitor real-time stats and compliance. Automated tools like Smart Trade Scanner can provide instant feedback and help you spot performance trends.

Keep a close eye on leaderboard positions and be ready to adapt tactics. Platforms with analytics features help you identify strengths and weaknesses. Automate routine tasks to focus on critical decisions.

Stay updated on market sentiment with integrated news feeds and economic calendars. Leveraging technology ensures you remain agile and informed throughout the prop firm competition.

Step 5: Engage with the Community and Learn from Peers

No trader wins a prop firm competition in isolation. Engage with the community through Discord groups, webinars, and forums. Sharing strategies and results with peers accelerates your learning curve.

Seek mentorship from experienced traders and participate in live events or knowledge-sharing sessions. Both Atlas Funding and The5ers offer active communities with educational opportunities. Firms often host networking events to help you connect with like-minded competitors.

Being active in the community provides support, motivation, and invaluable insights. Building relationships can also lead to future collaborations in the prop firm competition space.

Step 6: Execute with Discipline and Adaptability

Discipline is the backbone of success in any prop firm competition. Stick to your trading plan, even during periods of volatility or emotional swings. Track your daily and overall performance against the competition’s metrics.

Top performers know how to adapt. Adjust your approach as markets shift, but avoid overtrading or chasing losses. Use setbacks as learning opportunities and celebrate small milestones to keep morale high.

Prepare contingency plans for unexpected events. Consistent execution and adaptability will set you apart from the majority in every prop firm competition.

Step 7: Prepare for Payouts and Next Steps

As you approach the finish line in a prop firm competition, focus on understanding the payout process. Review the procedures for claiming prizes, upgrading accounts, and verifying your performance record.

Plan how to scale up, whether by reinvesting winnings into larger challenges or leveraging your track record for instant funding opportunities. Some firms allow account scaling at each 10 percent profit milestone.

Explore long-term paths, such as becoming a full-time funded trader or contributing as a mentor within the community. Each competition is a stepping stone toward your ultimate trading career. Use feedback from your experience to refine your skills for future prop firm competition success.

Common Pitfalls and How to Avoid Them

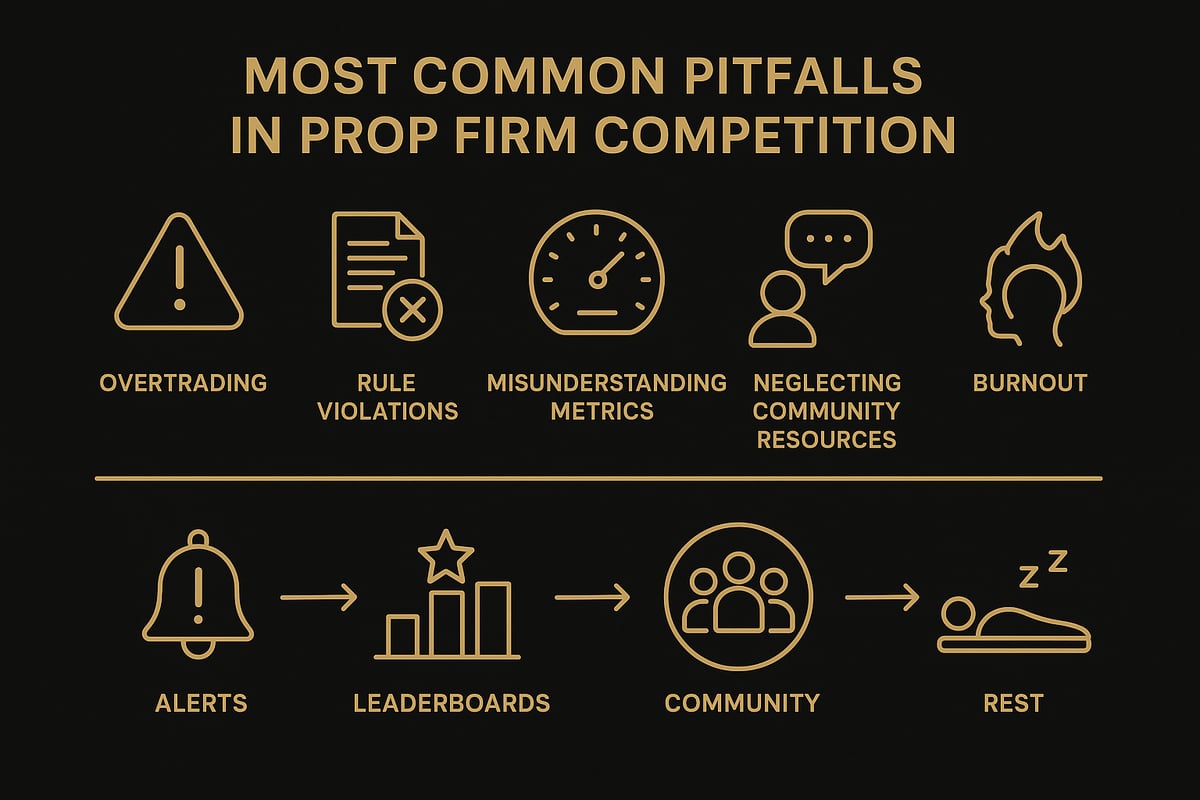

Entering a prop firm competition can be both exciting and daunting. Many traders make avoidable mistakes, often due to pressure or lack of preparation. By understanding these common pitfalls, you can improve your chances of success and avoid disqualification.

Overtrading and Rule Violations

A frequent challenge in any prop firm competition is overtrading and breaking rules. The drive to climb the leaderboard can push traders to exceed position limits, ignore loss thresholds, or take unnecessary risks. These mistakes often lead to instant disqualification, especially in high-stakes contests.

Common violations include:

Surpassing daily or maximum loss limits

Opening more positions than allowed

Using prohibited strategies, such as EAs or copy trading

To avoid these issues, set up alerts for key thresholds and review the profit payout policy for traders to understand the consequences of rule breaches. Discipline is crucial—stick to your plan and use compliance checklists daily.

Misunderstanding Competition Metrics

In a prop firm competition, focusing only on profit and loss (PnL) can be misleading. Most leaderboards use multiple metrics, such as win rate, drawdown, and average trade size. Ignoring these can hurt your ranking and your ability to win.

Key metrics to track include:

Total PnL and win rate

Maximum and daily drawdown

Best winner and average trade size

Use real-time dashboards to monitor your standing on all criteria. Top performers in prop firm competition environments often balance risk and reward, demonstrating consistency across all metrics. Review leaderboard stats frequently and adjust your approach as needed.

Neglecting Community and Support Resources

A prop firm competition is not just about individual performance. Many traders underestimate the value of community and available resources. Failing to join Discord groups, attend webinars, or use knowledge bases means missing out on strategy tips, rule clarifications, and emotional support.

Ways to leverage the community:

Participate in firm-hosted events and discussions

Seek mentorship or peer feedback

Share your experiences and learn from others

Active engagement in the prop firm competition community builds your network and boosts your learning curve. Use available support channels for quick issue resolution and stay updated on competition news.

Unrealistic Expectations and Burnout

Many new entrants in a prop firm competition expect rapid success or immediate payouts. With thousands of participants, the competition is fierce and requires careful pacing. Unrealistic goals can lead to stress, fatigue, and eventually burnout.

Set achievable targets and recognize the scale of the challenge. According to Prop Trading Statistics 2025, participation numbers are rising, making it harder to secure top prizes. Balance trading with rest and continuous learning, and remember that long-term growth is more valuable than a single win.

Leveraging Technology and Community for a Competitive Edge

Adapting to the fast-paced world of prop firm competition in 2026 requires both technological savvy and active community participation. Traders who combine advanced tools with a strong network gain a clear advantage. In this section, we explore how to harness these resources for maximum impact.

Automated Evaluation and Performance Tracking

Modern prop firm competition platforms use automated tools to track every trade in real time. Features like instant dashboards, performance analytics, and compliance alerts minimize manual errors and help traders stay on top of key metrics. For example, some firms offer dual-book engines that allow seamless account transitions and instant updates.

By leveraging these systems, traders can review their stats, compare progress to top performers, and quickly adjust strategies. Automation also supports instant funding options, as explained in the Instant funding model overview, allowing traders to access simulated capital without lengthy evaluations. Staying tech-savvy is crucial for standing out in any prop firm competition.

Community Engagement and Continuous Learning

Success in prop firm competition often depends on the strength of your community connections. Active participation in Discord groups, webinars, and trading forums enables traders to exchange strategies, share market news, and access mentorship. These interactions foster a culture of peer support and ongoing education.

Joining firm-hosted events or collaborating on team challenges can provide fresh perspectives and boost motivation. A vibrant trading community also offers emotional support during tough periods, making it easier to stay focused and resilient throughout any prop firm competition.

Scaling Up: From Competition to Career

Winning a prop firm competition is just the beginning. Traders who document their achievements and maintain a verified track record can unlock larger account sizes and new earning opportunities. Many firms offer account scaling, where consistent performance leads to access to higher simulated capital and better profit splits.

Building a professional reputation within the trading community opens doors to mentorship roles, advanced challenges, and even instant funding paths. By approaching each prop firm competition as a career milestone, traders lay the groundwork for long-term success in the industry.

Staying Ahead of Regulatory and Industry Changes

The landscape of prop firm competition is shaped by evolving regulations, global expansion, and advances in technology. Traders need to stay informed about rule updates, restricted countries, and industry trends. Engaging with firm-provided alerts and participating in industry forums ensures compliance and readiness for change.

Recent industry shifts, including the impact of AI and gamification, are well documented in The Great Shake-Out: How 2025 Reshaped the Prop Trading Industry. By staying proactive, traders can adapt to new standards and maintain a competitive edge in every prop firm competition.

You’ve just explored how the 2026 prop firm competition scene is evolving—fiercer contests, smarter technology, and bigger rewards are all at your fingertips. If you’re ready to put these strategies into action and see how far your trading skills can take you, there’s never been a better time to take the next step. Aeon Funded offers instant funding, advanced performance tools, and up to a 95% profit split—all in a transparent, supportive environment. Why wait to turn your trading ambitions into real results? Get Funded and start building your future in the new era of prop trading.

Article written using RankPill.