Funded Trade Plus Guide: Mastering the Platform in 2026

Master Funded Trade Plus with this 2026 guide covering payout rules, profit splits, withdrawal steps, risk management, and top strategies for trading success.

Jan 15, 2026

Ready to unlock your trading potential and maximize profits with funded trade plus in 2026? This guide is your complete roadmap to mastering the platform, covering every critical detail you need for success.

Discover step-by-step instructions on payout eligibility, withdrawal processes, profit split tiers, and account management. Learn how to navigate risk management rules, boost your earnings, and get answers to the most common questions.

With industry-leading payout features and exclusive 2026 insights, you will gain the knowledge and confidence to take full advantage of fast withdrawals and high profit splits. Let’s take the first step toward mastering funded trade plus.

Understanding Funded Trade Plus: Platform Overview & Key Features

Navigating the world of proprietary trading in 2026 means knowing which platforms empower traders with capital, speed, and transparency. Funded trade plus stands out by offering global traders a unique opportunity to grow without risking personal funds.

What is Funded Trade Plus?

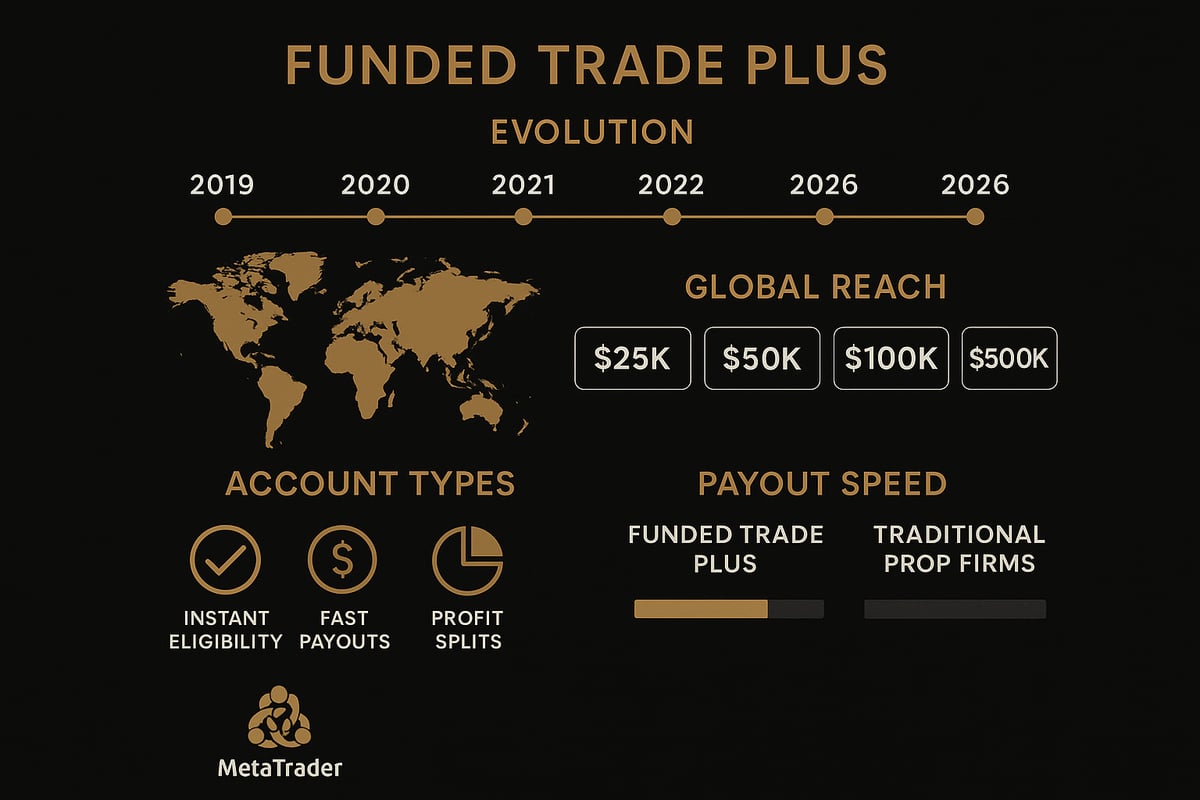

Funded trade plus began as a small-scale prop trading initiative and has grown into a global leader by 2026. The platform was built to solve a core industry problem: talented traders often lack access to significant capital. By removing personal financial risk, funded trade plus lets traders focus on performance, not fear.

Accounts range from $25,000 to a staggering $2,500,000, catering to both new and seasoned traders. Each funded trade plus account operates in a simulated trading environment, mirroring real market conditions. This approach ensures fair evaluation and risk-free capital access.

A new trader can open a $100,000 funded trade plus account, pass the evaluation, and immediately begin trading with the firm’s capital. The process is streamlined, with instant eligibility and no unnecessary delays.

Core Features and Benefits for Traders

What sets funded trade plus apart? The platform offers day-one payout eligibility, enabling withdrawals as soon as traders are in profit. Weekly payouts, a progressive profit split system (starting at 80/20 and reaching 100/0), and multiple withdrawal methods—including bank transfer, PayPal, and crypto—make the experience flexible and fast.

Key benefits include:

Rapid account review and transparent risk checks

Strict but fair drawdown and risk management rules

Compatibility with major trading platforms like MetaTrader and NinjaTrader

A standout advantage is the weekly withdrawal schedule. Unlike traditional prop firms, where traders might wait weeks for profits, funded trade plus processes most payouts within hours.

For a comprehensive look at how these features compare and what traders can expect, see this Funded Trading Plus Review 2026.

Who Should Use Funded Trade Plus?

Funded trade plus is designed for a wide range of traders. Aspiring traders gain access to capital without risking their savings. Experienced professionals can scale with high profit splits and reliable infrastructure. Those who value speed, transparency, and flexibility will find the platform especially appealing.

According to industry data, 72% of traders rate the payout structure of funded trade plus as the top in the industry. Whether you are new or seasoned, if you want to maximize your trading potential in 2026, funded trade plus is built for you.

Step-by-Step: Payout Eligibility & Withdrawal Process

Unlocking your first payout on funded trade plus is a streamlined process designed for transparency and speed. By following each step closely, you can ensure your withdrawals are processed quickly and without hassle. Let’s break down every stage so you can confidently navigate the payout journey.

Step 1: Meeting Payout Eligibility Requirements

To request your first withdrawal from funded trade plus, you need to achieve a minimum of $50 profit above your starting balance. There are no minimum trading days required, making you eligible for payouts from your very first day.

Before you submit a withdrawal, ensure all trades are closed. For example, if you start with a $100,000 account and grow it to $100,050, you immediately qualify for withdrawal.

The platform’s approach puts flexibility in your hands. For a detailed walkthrough, visit the Payout eligibility and withdrawal process guide.

Step 2: Choosing Withdrawal Methods & Understanding Processing Times

Funded trade plus supports multiple withdrawal methods to suit your needs: bank transfer, PayPal, and cryptocurrency. Bank transfers typically take 3 to 5 business days, PayPal requires 1 to 2 business days, and cryptocurrency withdrawals are completed within minutes to hours.

Most payout requests are processed within just 2 hours, and all are finalized within 48 hours. Many traders prefer crypto for the fastest access to their funds.

For instance, a trader withdrawing via crypto often receives their payout the same day, making this method highly popular.

Step 3: Currency and Account Details

All payouts from funded trade plus are made in USD, regardless of your country. This standardization simplifies the process and avoids currency conversion issues for international traders.

Account sizes impact your potential payout amounts, but the withdrawal process remains identical across all tiers. Always ensure your account details and identification match your profile to prevent delays.

An international trader, for example, can receive their payout in USD without worrying about local currency conversions, ensuring fast and seamless transactions.

Step 4: Navigating the Weekly Withdrawal Schedule

Withdrawals on funded trade plus are available every 7 calendar days after your first successful payout. There is no cap on the number of withdrawals, provided you meet the eligibility criteria each time.

This schedule makes it easy to plan consistent income, whether you prefer weekly withdrawals or less frequent, larger payouts.

For example, a trader may choose to withdraw profits every week, aligning with personal financial goals and creating a steady cash flow.

Step 5: Risk Review and Compliance

Each payout on funded trade plus undergoes a comprehensive risk review to ensure all trading activity complies with platform rules. Only accounts that have closed all trades and passed compliance checks are approved for withdrawal.

Common reasons for payout delays include open trades, mismatched account details, or risk management violations. Always double-check your account before submitting a request.

For example, forgetting to close a position or entering incorrect payment information can lead to unnecessary delays, but these are easily avoided with a quick review.

Mastering the Profit Split & Tier System

Unlocking the full earning potential on funded trade plus starts with understanding how the profit split and tier system work. This structured approach rewards consistent performance and helps traders maximize their share of the profits as they progress.

How the Profit Split Model Works

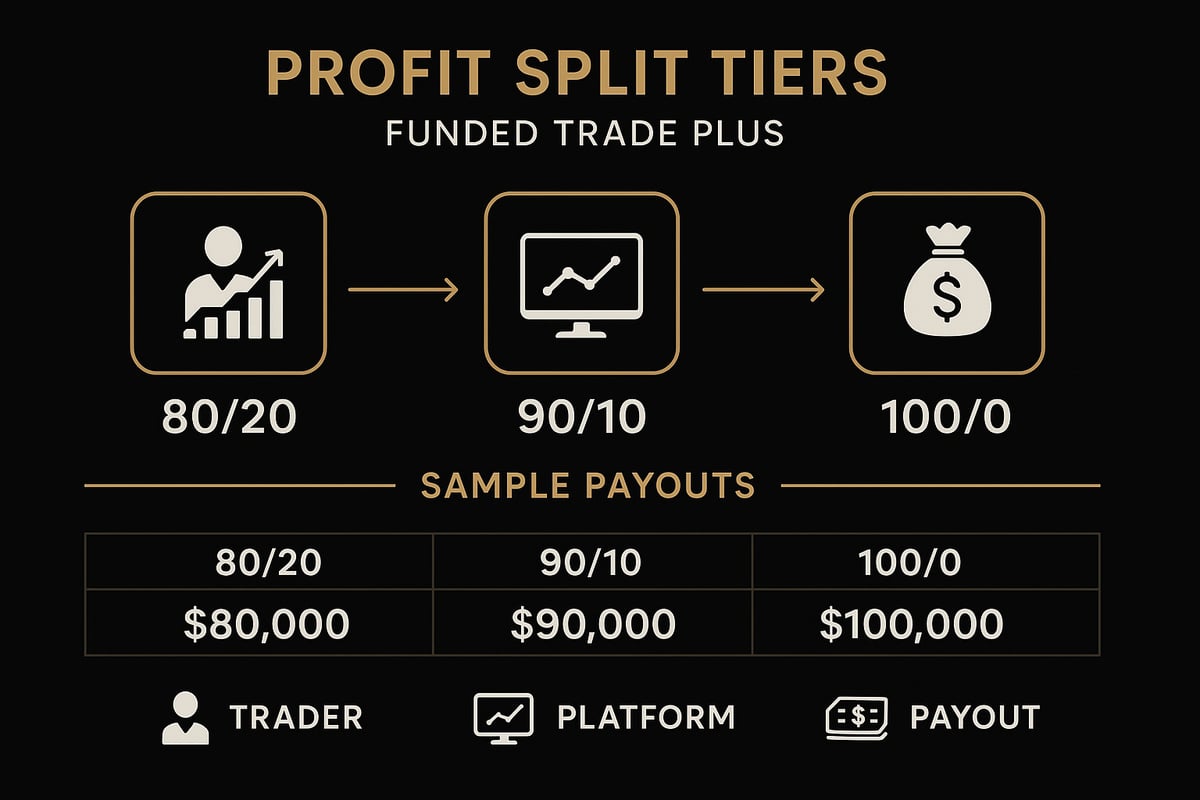

The profit split model at funded trade plus is designed to incentivize traders from the very beginning. Every trader starts with an 80/20 split, meaning you keep 80% of your profits while the platform retains 20%.

Once you demonstrate consistent profitability, your split improves. After reaching a 20% simulated profit target, you unlock a 90/10 split. Achieve a 30% simulated profit, and you move to an industry-leading 100/0 split, keeping all future profits.

This progressive model applies to all major programs, including Master Trader, Two-Phase Prestige, and Experienced Trader. For example, a trader starting with a $100,000 funded account can immediately begin earning payouts at the 80/20 level, then graduate to higher tiers as performance milestones are met.

The tiered system gives funded trade plus traders a clear path to increasing their profit share with every successful withdrawal.

Tier Milestones and Progression

Funded trade plus uses well-defined tier milestones to reward traders for sustained performance. Here’s how progression works:

Tier 1 (80/20): All traders start here upon account activation.

Tier 2 (90/10): Reach a cumulative simulated profit of 20% to upgrade.

Tier 3 (100/0): Achieve a 30% cumulative simulated profit for the maximum split.

Each new tier applies to all future withdrawals, regardless of the program you’re in. For instance, if a trader advances through the tiers within 12 months, every withdrawal after reaching Tier 3 is at the 100/0 split.

This structure motivates traders to focus on consistent gains rather than one-off big wins. It ensures that as your skills and results grow, so does your share of the profits. With funded trade plus, the journey through the tiers is transparent, merit-based, and designed to benefit disciplined traders.

Profit Split Calculation Examples

To see the impact of the funded trade plus profit split system, consider these examples for a $100,000 account:

Tier | Profit Made | Split | Trader Receives | Platform Share |

|---|---|---|---|---|

Tier 1 | $15,000 | 80/20 | $12,000 | $3,000 |

Tier 2 | $10,000 | 90/10 | $9,000 | $1,000 |

Tier 3 | $5,000 | 100/0 | $5,000 | $0 |

As you move up the tiers, your take-home portion increases dramatically. For example, a trader who grows their account and consistently hits profit milestones can see their earnings potential rise with each tier. This system is unique to funded trade plus, as most traditional prop firms keep tighter restrictions and lower splits, especially for new traders.

Visualization and clear calculations help traders map out their earning journey and set realistic targets for advancement.

Impact on Trader Earnings Potential

The tiered profit split model on funded trade plus is built to maximize your earning potential over time. By starting at 80/20 and progressing to 100/0, traders are incentivized to pursue steady, long-term growth. Compared to other prop firms that often cap splits at 80% or delay upgrades, funded trade plus stands out for its transparency and generosity.

A recent industry survey shows that 72% of traders consider the profit split system at funded trade plus to be the best available. This is due not only to the high percentages but also the clear path to full profit retention with no hidden restrictions.

For a deeper dive into the payout rules and exact tier mechanics, explore the Profit payout policy explained for comprehensive details. Using the tier system, disciplined traders can project their lifetime earnings and plan their trading careers with confidence.

Consistent results, a transparent split structure, and industry-leading terms make funded trade plus the preferred choice for traders seeking maximum returns.

Essential Payout Rules & Account Conditions

Navigating payout rules and account conditions is crucial for maximizing your success with funded trade plus. Understanding these requirements not only protects your capital but also ensures you remain eligible for withdrawals and tier advancements. Let’s break down the essentials every trader needs to know.

Understanding Drawdown Limits

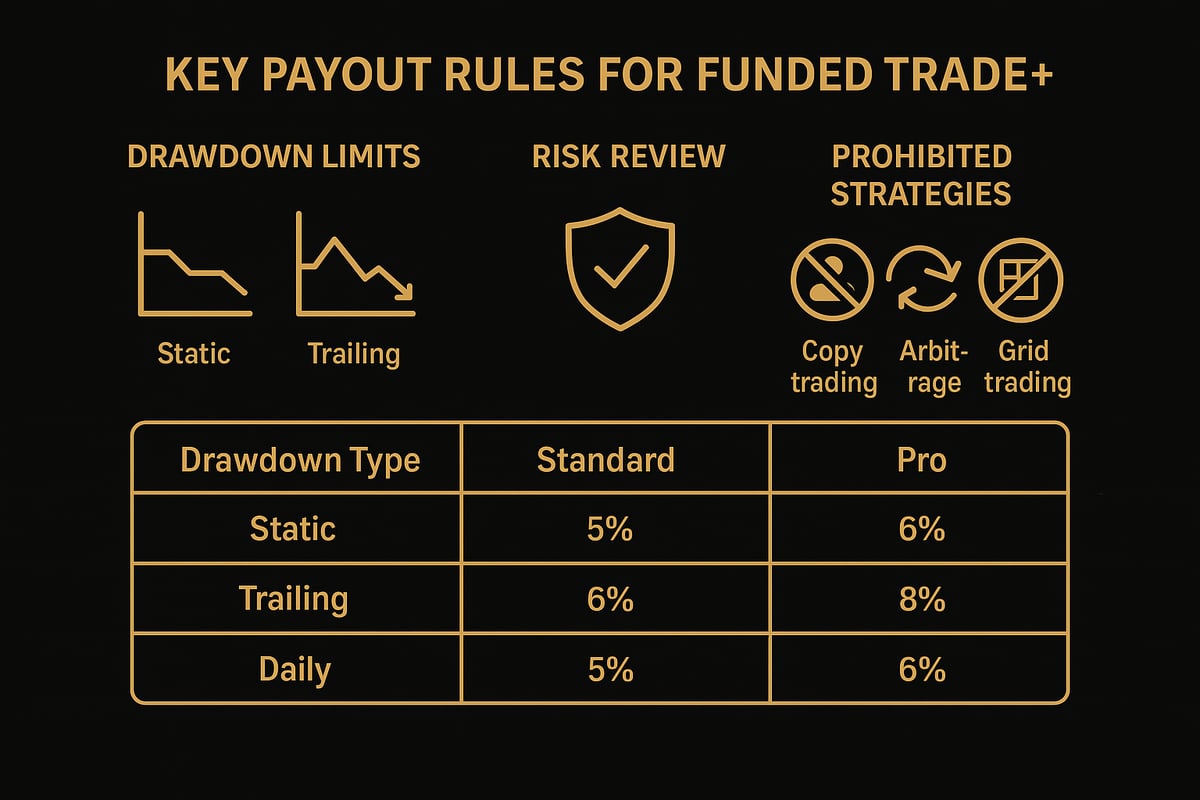

Drawdown limits are at the heart of risk management on funded trade plus. Each program enforces its own rules, so knowing the specifics is vital.

There are three main drawdown types:

Relative (Trailing) Drawdown: Adjusts as your balance grows.

Static Drawdown: Fixed at your initial account balance.

Daily Drawdown: A daily cap, resetting at 4:59 PM EST.

Here’s a quick reference table:

Program | Drawdown Type | Limit |

|---|---|---|

Master Trader | Relative | 6% trailing |

Prestige | Static | 10% static |

All Programs | Daily | 4% daily |

For example, if you hold a $100,000 Master account, your trailing drawdown starts at $94,000 and moves up as your account grows. This flexibility helps safeguard both your profits and your funded trade plus eligibility.

Managing Account Conditions

To thrive on funded trade plus, you must manage your account within strict limits. Every account has a maximum simulated loss and a daily loss cap. Exceeding either instantly ends your payout eligibility.

Automated risk reviews monitor every trader’s performance. If you breach your drawdown, your account is flagged and profits forfeited. Imagine a trader with a $100,000 account who lets a loss spiral past $6,000 in one session. They lose all eligibility for funded trade plus payouts and must start over.

Stay vigilant:

Track your open trades and floating PnL.

Calculate your drawdown buffer before every session.

Use alerts or platform tools to avoid accidental breaches.

Relative vs. Static Drawdown: What Traders Need to Know

Funded trade plus offers both relative and static drawdown options, depending on your chosen program. Relative drawdown increases as your account balance grows, giving you more room to trade as you profit. Static drawdown, by contrast, remains fixed at your starting balance.

Let’s say your account grows from $100,000 to $110,000. On a relative drawdown program, your stop-out buffer expands, reflecting your trading success. This can be a huge advantage for disciplined traders on funded trade plus, providing more flexibility and opportunity for larger profits.

Always match your strategy to the drawdown type. Aggressive traders might prefer static drawdown for predictability, while growth-focused traders can leverage relative rules for scalability.

Strict Compliance: Rules for All Funded Accounts

Compliance is non-negotiable with funded trade plus. The platform prohibits activities such as:

Copy trading

Arbitrage

Hedging

Grid trading

While EAs and news trading are generally allowed, use them responsibly. Any violation—intentional or accidental—results in immediate account termination and loss of profits.

Common mistakes that lead to disqualification include:

Failing to close all trades before withdrawal

Providing incorrect account details

Using restricted strategies

For a full list of rules and restricted practices, review the Essential trading rules and restrictions resource. Staying compliant is the only way to keep earning with funded trade plus.

Strategies to Maximize Your Payouts & Trading Success

Unlocking the full earning potential on funded trade plus requires more than just trading skill. It demands a disciplined, strategic approach that maximizes payouts while protecting your account. By focusing on performance consistency, robust risk management, smart use of trading tools, withdrawal planning, and community learning, traders can turn opportunity into sustainable income.

Consistent Performance for Tier Advancement

Progressing through the profit split tiers on funded trade plus starts with consistency. Develop a clear trading plan and stick to it, recording every trade and thought in a journal. This habit builds discipline and helps identify patterns in your performance. Focus on mastering one strategy rather than jumping between methods, as steady gains are rewarded with higher profit splits.

Set realistic daily and weekly goals. Review your trades regularly to ensure you are moving toward the next tier. Consistent execution, not sporadic wins, is what unlocks the path from 80 percent to a full 100 percent profit split on funded trade plus.

Risk Management & Drawdown Control

Protecting your capital is critical for long term success with funded trade plus. Always set stop losses on every position and size your trades appropriately to stay within platform limits. Diversify your trades to avoid large single-position losses. Use daily loss limits as a safeguard against emotional decisions.

For a deeper understanding of how daily loss and drawdown mechanics work on funded trade plus, review Managing daily loss limits. Regular risk checks and alerts can help you stay compliant, prevent breaches, and ensure ongoing payout eligibility.

Leveraging Trading Infrastructure & Tools

The infrastructure you use can make or break your results on funded trade plus. Choose platforms like MetaTrader or NinjaTrader that offer low latency execution, reducing slippage and protecting your profits. Take advantage of professional grade charting, automated tools, and trade management features.

Fast, reliable execution is especially important during high volatility. Test your setup before scaling up. Use practice environments to ensure your strategies work smoothly with the funded trade plus systems. The right tools can give you a measurable edge over the competition.

Planning Withdrawals for Sustainable Income

Strategic withdrawal planning is essential to building lasting income on funded trade plus. Schedule your withdrawals to align with your personal financial goals, making use of the platform's weekly payout cycle. Avoid the temptation to overtrade or take excessive risks just to increase short term payouts.

Consider setting aside a portion of each withdrawal for taxes or future trading reserves. Use a calendar to track your eligibility dates and plan regular withdrawals. This disciplined approach helps you maintain a healthy trading mindset and ensures you benefit fully from the unique payout structure of funded trade plus.

Community Support & Continuous Learning

Success on funded trade plus is not achieved in isolation. Engage with trader communities, forums, and mentorship groups for support and accountability. Sharing experiences and learning from others can help you adapt to market changes and platform updates.

Stay informed about new features, rule changes, and strategy developments on funded trade plus. Attend webinars, read platform announcements, and participate in discussions. Continuous learning and a strong network can keep you motivated and help you navigate the ever evolving world of funded trade plus.

FAQs: Top Questions About Funded Trade Plus in 2026

Navigating the world of funded trade plus can spark plenty of questions, especially as rules and features evolve in 2026. Below, we address the most common queries to help you master the platform and maximize your trading career.

How does the profit split system impact my long-term earnings?

The profit split system at funded trade plus is designed to reward consistent performance. Traders start with an 80/20 split, keeping 80% of profits. As you reach higher profit milestones, your share rises to 90%, then 100%. This tiered approach can dramatically boost your cumulative earnings over time. For a deeper understanding, see Understanding Profit Splits in Prop Trading.

Imagine earning $50,000 in profits by steadily advancing through the tiers. Over the years, this system can significantly increase your take-home pay compared to fixed split models.

What are the most common reasons for payout delays or denials?

Payouts may be delayed or denied for several reasons:

Open trades at the time of request

Account detail mismatches

Flags during risk review

To ensure smooth withdrawals from funded trade plus, always close all positions, double-check your account information, and review your trading activity for compliance before submitting a request. A simple pre-withdrawal checklist can prevent unnecessary delays.

How can I avoid breaching drawdown limits?

Managing risk is key on the funded trade plus platform. Use practical steps like:

Setting daily and overall loss alerts

Reviewing your positions regularly

Sticking to your predefined risk parameters

Using these methods helps keep your account within limits and maintains payout eligibility. For more on how prop trading firms manage risk, see How Prop Trading Firms Manage Risk.

Which withdrawal method is best for fast payouts?

Funded trade plus offers multiple withdrawal methods, each with its own speed:

Method | Processing Time |

|---|---|

Crypto | Minutes to hours |

PayPal | 1–2 business days |

Bank Transfer | 3–5 business days |

Crypto is generally the fastest, often delivering funds within minutes. Many traders choose crypto for rapid access, while others prefer PayPal or bank transfer for convenience. Your choice may depend on location and personal preference.

Can I use automated trading strategies or EAs?

Yes, funded trade plus allows automated trading strategies and EAs, provided you follow platform guidelines. News trading is also permitted with responsible use. Avoid prohibited tactics like copy trading or arbitrage, as these can result in immediate account termination.

Best practice is to test automation strategies in a demo environment first, then ensure all settings comply with platform rules.

What happens if my account is terminated for rule violations?

If you break the rules on funded trade plus, your account is terminated immediately, and any profits are forfeited. Common reasons include breaching drawdown limits or using banned strategies. To avoid accidental violations:

Review rules regularly

Monitor your strategies

Double-check trade compliance

Prevention is always better than cure in prop trading.

Are there any hidden fees or restrictions?

Funded trade plus is transparent about all fees and conditions. You pay only the agreed program or evaluation fee, with no hidden costs. Below is a comparison with typical competitor platforms:

Platform | Hidden Fees | Payout Restrictions |

|---|---|---|

Funded Trade Plus | None | Minimal |

Traditional Prop Firm | Possible | Common |

Always review the fee structure before joining. Funded trade plus stands out for its honesty and minimal restrictions.

FAQs: Top Questions About Funded Trade Plus in 2026

Navigating the world of funded trade plus can raise many important questions. Below, you will find clear answers to the most common topics traders ask about, from profit splits to risk management and withdrawal speed. Each answer is tailored to help you make the most of your funded trade plus experience.

How does the profit split system impact my long-term earnings?

The tiered profit split model at funded trade plus can significantly increase your lifetime earnings as you progress. Starting at 80/20, reaching 90/10 after 20% profit, and ultimately achieving 100/0 after 30% profit, your share of profits grows with consistent performance. For a deep dive into how these profit-sharing models compare across the industry, see the Business Models of Prop Trading Firms. For example, a trader who steadily advances through the tiers can see exponential gains over the years, especially as all future withdrawals benefit from the highest split attained.

What are the most common reasons for payout delays or denials?

Payouts from funded trade plus may be delayed or denied for several reasons, including:

Open trades at the time of withdrawal request

Account detail mismatches or incomplete identification

Risk review flags due to non-compliant trading activity

To ensure smooth withdrawals, always close all positions and double-check your account details before submitting a request.

How can I avoid breaching drawdown limits?

To stay compliant with funded trade plus drawdown rules:

Set daily and maximum loss alerts

Use stop-loss orders on every trade

Review your account performance daily

The platform also offers tools to help you monitor your risk and avoid accidental breaches.

Which withdrawal method is best for fast payouts?

Funded trade plus offers several withdrawal options. Cryptocurrency is typically the fastest, processing within minutes to hours. PayPal usually clears in 1–2 business days, while bank transfers can take 3–5 business days. Many traders prefer crypto for rapid access, but always choose the method that best fits your needs.

Method | Typical Processing Time |

|---|---|

Cryptocurrency | Minutes to hours |

PayPal | 1–2 business days |

Bank Transfer | 3–5 business days |

Can I use automated trading strategies or EAs?

Automated strategies and EAs are generally allowed on funded trade plus, provided they do not engage in prohibited activities like copy trading, arbitrage, or grid trading. Always test your automation for compliance, and monitor trades closely during high-impact news events.

What happens if my account is terminated for rule violations?

If you violate the platform’s rules, funded trade plus will immediately terminate your account and forfeit any profits. Common reasons include breaching drawdown, using restricted strategies, or providing false information. Always review the rules and maintain strict compliance to protect your eligibility.

Are there any hidden fees or restrictions?

Funded trade plus is transparent about all costs and payout conditions. There are no hidden fees, and all program fees or commissions are clearly outlined before you begin. Compared to many competitors, this approach reduces surprises and makes it easier to plan your trading finances.

After exploring how Funded Trade Plus empowers you with instant funding, high profit splits, and transparent rules, you now have a clear roadmap to mastering the platform in 2026. Whether you’re aiming for day-one payouts, seamless withdrawals, or steady advancement through the profit split tiers, everything is designed to put your trading skills—and your earnings—front and center. If you’re ready to put your knowledge into action and take the next step toward real capital and industry-leading profit opportunities, Get Funded and start your journey with confidence.