Leeloo Prop Firm Guide: Your 2026 Success Roadmap

Unlock trading success in 2026 with our expert Leeloo prop firm guide. Discover strategies, avoid pitfalls, and compare top firms to maximize your funded trading career.

Jan 16, 2026

Ready to elevate your trading game in 2026? The right prop firm can unlock new heights, and leeloo prop firm offers a gateway for traders seeking professional growth.

This comprehensive guide gives you a clear roadmap to mastering Leeloo, from understanding its unique structure to navigating the evaluation and scaling processes.

Explore what sets Leeloo apart, step-by-step instructions to get funded, top strategies for maximizing returns, common pitfalls to avoid, and how Leeloo compares to other leading prop firms.

Discover the opportunities ahead, build your trading confidence, and take the next step toward lasting trading success.

Understanding Leeloo Prop Firm: Structure, Rules, and Offerings

Unlocking the full potential of your trading journey in 2026 starts with a deep understanding of the leeloo prop firm. As one of the most recognized names in proprietary trading, Leeloo has established itself as a leading choice for traders seeking flexible account options, competitive payouts, and straightforward rules.

Leeloo has positioned itself at the forefront of the prop trading market by consistently innovating its offerings and adapting to trader needs. In 2026, leeloo prop firm continues to stand out due to its transparent evaluation process, robust support, and a user-centric approach that appeals to both new and experienced traders.

Leeloo Account Types: Evaluation, Express, and Funded

Leeloo prop firm offers a range of account types designed for different trading styles and goals. The three main categories are Evaluation, Express, and Funded accounts.

Evaluation Accounts: These require traders to meet specific profit targets and risk parameters over a set number of trading days. They are ideal for those looking to demonstrate disciplined trading before accessing live capital.

Express Accounts: A fast-track solution for traders who want to bypass traditional evaluation steps. Express accounts have different fee structures and may offer quicker access to funded status.

Funded Accounts: After successfully completing an evaluation or express phase, traders receive a funded account. This enables them to trade real capital and share in the profits.

For a detailed breakdown of Leeloo’s account sizes, contract limits, and monthly fees, traders can review Leeloo Trading's Account Types and Pricing, which highlights how to select the most suitable account for your trading objectives.

Here’s a quick comparison:

Account Type | Evaluation | Express | Funded |

|---|---|---|---|

Purpose | Prove skill | Fast-track | Trade live capital |

Fee Structure | Low to moderate | Higher one-time | No fee, revenue share |

Timeline | Set days | Immediate | Ongoing |

Drawdown Rules | Strict | Moderate | Varies |

Account Sizes, Pricing, and Profit Split Models

Leeloo prop firm provides various account sizes, typically ranging from $25,000 up to $250,000 or more. Each account size has its own pricing tier, often with monthly or one-time fees depending on the chosen plan.

Profit splits are another major attraction. In 2026, most traders start with an 80/20 split, meaning they keep 80% of profits, with the potential to increase this to 90/10 after meeting certain performance milestones. This competitive model allows traders to maximize their earnings as they scale.

Account Size | Typical Fee | Initial Profit Split | Max Contracts |

|---|---|---|---|

$25,000 | $77/month | 80/20 | 2 |

$50,000 | $167/month | 80/20 | 5 |

$100,000 | $220/month | 80/20 | 10 |

$250,000 | $375/month | 80/20 | 20 |

Trading Rules: Risk, Drawdown, and Consistency

To maintain a fair and sustainable environment, leeloo prop firm enforces several key trading rules:

Daily Loss Limits: Traders must not exceed a specified daily loss threshold.

Trailing Drawdown: This rule tracks the highest account balance and sets a maximum allowable drop, encouraging careful risk management.

Scaling Plan: Traders can increase contract limits as they demonstrate consistent profitability.

Consistency Requirements: Profits must be generated steadily, not from a single large trade.

These rules ensure that traders develop disciplined habits and protect both their own and the firm’s capital.

Supported Platforms, Asset Classes, and Trading Hours

Leeloo prop firm supports popular trading platforms such as NinjaTrader, which is known for its intuitive interface and powerful charting tools. The firm focuses on futures contracts, covering major asset classes like indices, commodities, and currencies. Trading hours typically align with CME market sessions, offering ample flexibility for global traders.

Unique Features: Resets, Express Passes, and Customer Support

Leeloo prop firm stands out with several trader-friendly features:

Resets: If a trader fails an evaluation, they can purchase a reset to try again without starting from scratch.

Express Passes: These give traders an accelerated path to funding, ideal for those with proven strategies.

Customer Support: Responsive assistance is available via live chat and email, ensuring traders get timely help with platform or account issues.

2026 Express Model vs. 2024: What’s New?

Comparing the 2026 Express Model to its 2024 predecessor, leeloo prop firm has introduced even more streamlined onboarding and reduced minimum trading day requirements. Fees have become more competitive, and scaling plans are more flexible, reflecting feedback from the growing trader community.

Leeloo’s Growth: User and Payout Statistics

Industry data shows that leeloo prop firm has experienced significant user growth since 2024, with thousands of traders funded and millions in payouts distributed. This trend highlights the firm’s reputation for transparency and trader success.

Understanding the structure, rules, and offerings of leeloo prop firm in 2026 provides a strong foundation for traders seeking to capitalize on the best opportunities in the prop trading world.

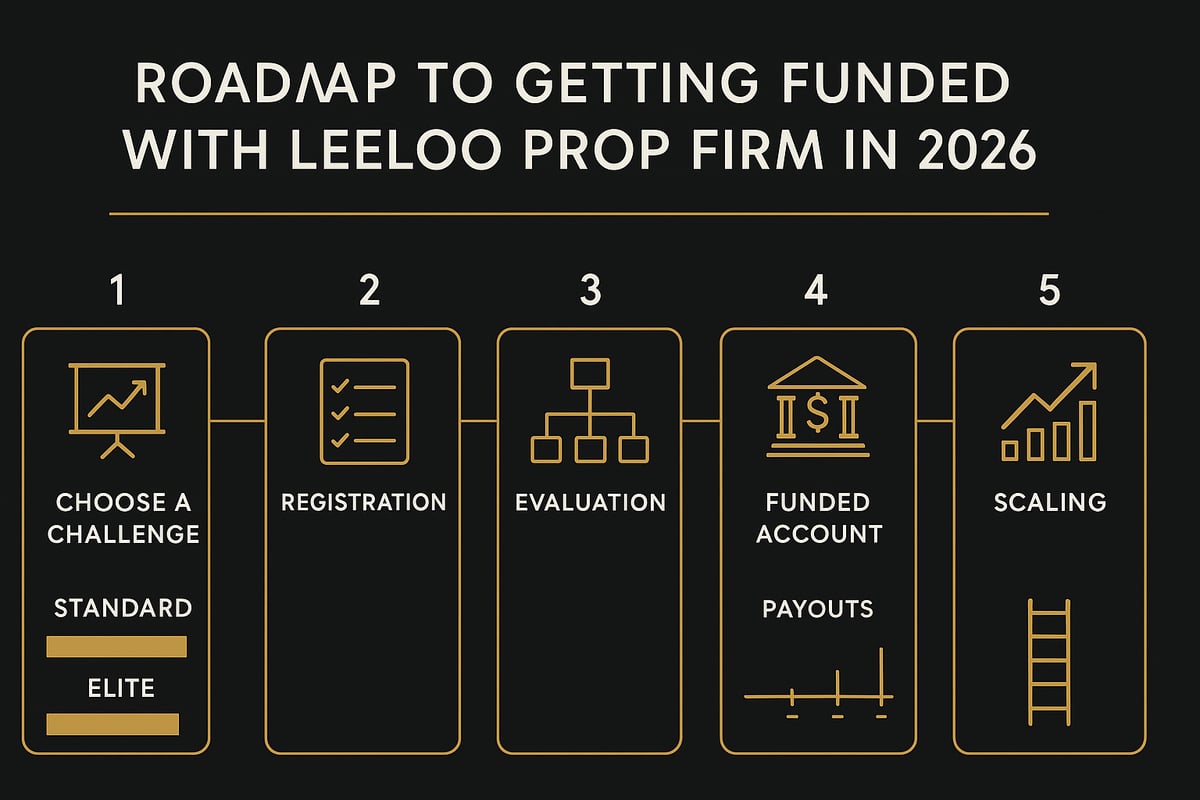

Step-by-Step Roadmap: How to Get Funded with Leeloo in 2026

Unlocking funding with leeloo prop firm in 2026 means following a precise, proven roadmap. Whether you are new to prop trading or a seasoned trader seeking to scale, understanding this process is essential. Let’s break down each critical step for success.

Step 1: Choosing the Right Leeloo Challenge

Selecting the ideal leeloo prop firm challenge is your first strategic decision. Account size, trading rules, and your style play a crucial role. Are you a swing trader or a scalper? Swing traders may prefer larger accounts with flexible trading windows, while scalpers often thrive with lower minimum trading days.

Compare leeloo prop firm pricing tiers carefully. For example, a $50,000 evaluation account may offer a lower upfront cost but stricter daily loss limits, while a $100,000 account grants more flexibility at a higher fee. Weigh the cost against the potential reward and ensure the profit split aligns with your goals.

Best practices:

Analyze your risk tolerance and preferred asset classes.

Check for express or standard evaluation options.

Review minimum trading days and profit targets.

Choosing the right leeloo prop firm challenge sets the foundation for your trading journey.

Step 2: Registration and Account Setup

Once you have chosen your leeloo prop firm challenge, the next step is seamless registration. Begin by visiting Leeloo’s website and filling out the sign-up form. You will need to provide personal details, proof of identity, and possibly address verification.

After registration, set up your trading platform, such as NinjaTrader, and connect it to your leeloo prop firm dashboard. Carefully review your account credentials, as errors here can delay your evaluation.

Avoid these common mistakes:

Entering incorrect personal information.

Missing required documentation uploads.

Overlooking platform compatibility.

A smooth setup ensures you are ready to focus on the evaluation phase with leeloo prop firm.

Step 3: Passing the Leeloo Evaluation

The evaluation phase is where your trading skills are put to the test. Leeloo prop firm evaluations typically have multiple phases, each with defined profit targets, minimum trading days, and strict risk management rules.

Stay disciplined. Track your daily loss limits and trailing drawdown requirements. Use a trading journal to document your trades and review performance. Most traders find a realistic timeline for passing is two to four weeks, depending on market conditions and trading frequency.

Key strategies:

Stick to your plan and avoid emotional trades.

Focus on consistency, not just reaching the profit target.

Monitor your compliance with all leeloo prop firm rules.

Successful completion of the evaluation is your gateway to funding.

Step 4: Transitioning to a Funded Account

After passing the evaluation, you will move to the funded trader phase with leeloo prop firm. This involves additional verification, signing agreements, and onboarding. You will unlock access to real capital, profit splits, and withdrawal options.

The onboarding process is straightforward. Review and sign the funding agreement, then set up your payout preferences. For a step-by-step breakdown, refer to Leeloo Trading's Evaluation Process, which outlines each milestone from evaluation to funded status.

What to expect:

Profit splits typically start at 80/20, with potential for 90/10 as you scale.

Withdrawals follow specific schedules and consistency rules.

Your first payout experience is a milestone—plan for compliance to ensure smooth processing.

Transitioning successfully means you are now trading real funds on behalf of leeloo prop firm.

Step 5: Scaling Up and Maximizing Your Leeloo Account

With a funded leeloo prop firm account, growth opportunities await. Leeloo’s scaling plan allows you to increase your trading limits as you demonstrate consistent profitability. Start by compounding your gains and adhering to risk management protocols.

For example, a trader who began with a $25,000 account and followed the scaling plan could reach $250,000 in under a year. Focus on steady gains rather than aggressive risk-taking.

Tips to maximize growth:

Maintain a disciplined approach and review your performance regularly.

Take advantage of scaling opportunities as you meet profit milestones.

Leverage leeloo prop firm resources and community for continued development.

Your long-term success depends on your ability to adapt, grow, and leverage every advantage offered by leeloo prop firm.

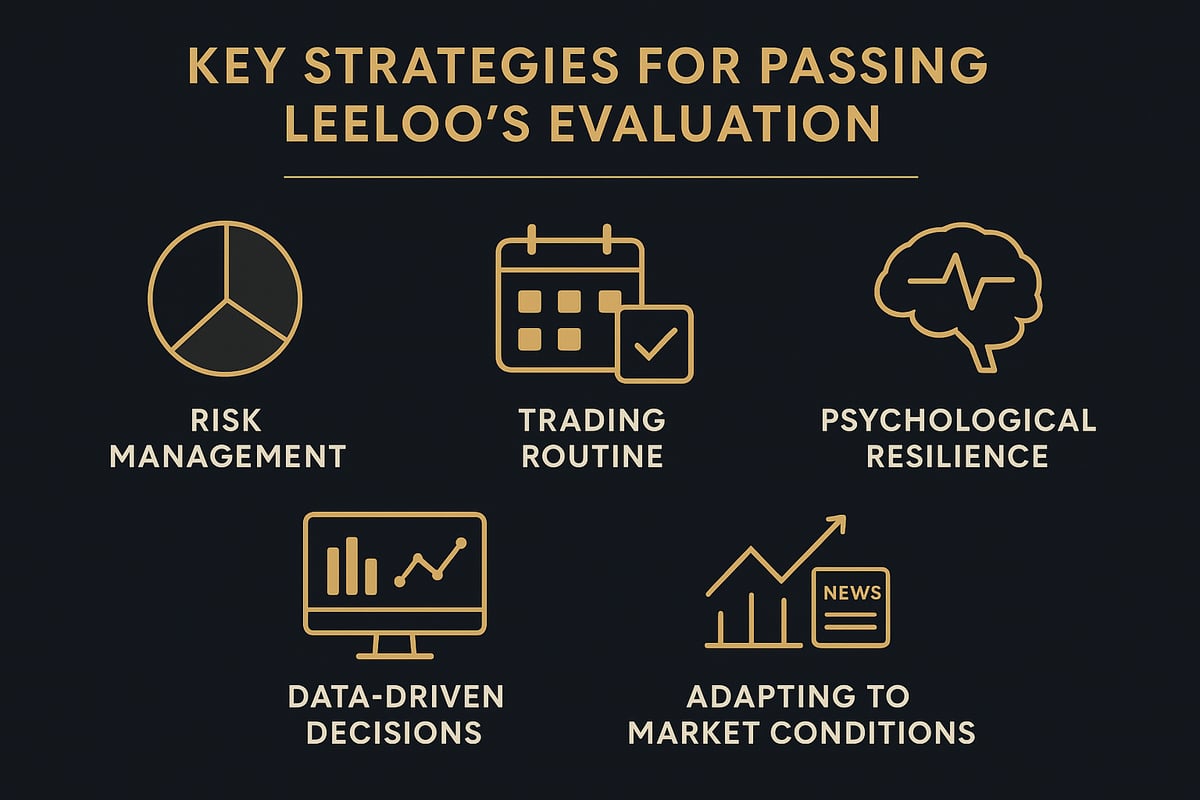

Key Strategies for Passing Leeloo’s Evaluation and Sustaining Success

Unlocking consistent results at leeloo prop firm requires more than just technical skill. To thrive through evaluation and maintain long-term profitability, traders must blend disciplined strategy, psychological resilience, and adaptable tactics. Here, we break down proven approaches that set apart successful leeloo prop firm traders in 2026.

Risk Management Techniques for Leeloo Traders

Effective risk management is the cornerstone of success at leeloo prop firm. Traders must control position size and use stop-loss orders to protect capital. Understanding daily loss limits and trailing drawdown is critical. For instance, if you trade a $50,000 account, risking no more than 1 percent per trade can help ensure longevity.

Leeloo prop firm enforces strict limits to prevent catastrophic losses. Always check your maximum daily loss and adjust trade size accordingly. Using a risk calculator can streamline this process. For more detail on these rules, see Managing Daily Loss in Prop Trading.

Example risk plan for $50k account:

Max risk per trade: $500

Daily loss cap: $1,000

Trailing drawdown: $2,000

Adhering to these parameters gives you the staying power needed for evaluation and beyond.

Developing a Consistent Trading Routine

Consistency is a hallmark of top leeloo prop firm traders. Start by setting a fixed schedule and sticking to it. Maintain a detailed trading journal, recording each trade’s rationale, outcome, and emotional state. This helps identify patterns and improve discipline.

Set clear, attainable goals for each day and week. For example, aim for a specific number of high-quality setups rather than a profit target alone. Review performance weekly to spot areas for improvement.

A sample routine might include pre-market analysis, trade planning, live execution, and end-of-day review. Over time, this structure increases your odds of passing the leeloo prop firm evaluation.

Psychological Edge: Handling Pressure and Avoiding Burnout

The mental side of trading is often underestimated in leeloo prop firm challenges. Evaluation periods can be stressful, leading to mistakes if not managed well. Develop routines like mindfulness practice or brief walks between sessions to stay sharp.

Stay disciplined by following your plan and avoiding impulsive trades. When setbacks occur, take a break to reset your mindset. Learning to accept losses as part of the process is vital.

Many successful traders credit their achievements to a resilient mindset. They view each evaluation as a learning opportunity, not just a test. This perspective can help you overcome pressure and remain focused on long-term goals.

Data-Driven Decision Making

Using analytics is essential for refining your approach at leeloo prop firm. Leverage trading dashboards to track metrics such as win rate, average loss, and drawdown. Data-driven reviews highlight what works and what needs adjustment.

For example, if your win rate drops during volatile periods, consider reducing size or trading less frequently. Reviewing trade statistics regularly ensures you are making informed decisions, not relying on gut feeling alone.

Leeloo prop firm provides performance reports that help traders identify strengths and weaknesses. Embrace these tools to optimize your strategy and sustain success through evaluation and beyond.

Adapting to Market Conditions in 2026

Markets evolve, and so should your strategy at leeloo prop firm. In 2026, rapid news cycles and algorithmic trading can increase volatility. Stay informed about economic events and be ready to adjust your plan.

Adopt flexible tactics, such as switching from trend-following to range trading when conditions change. Monitor rule updates from leeloo prop firm to ensure compliance as requirements shift.

Traders who adapt quickly to new environments are more likely to pass evaluations and maintain funded status. By combining adaptability with the strategies above, you can thrive at leeloo prop firm in any market climate.

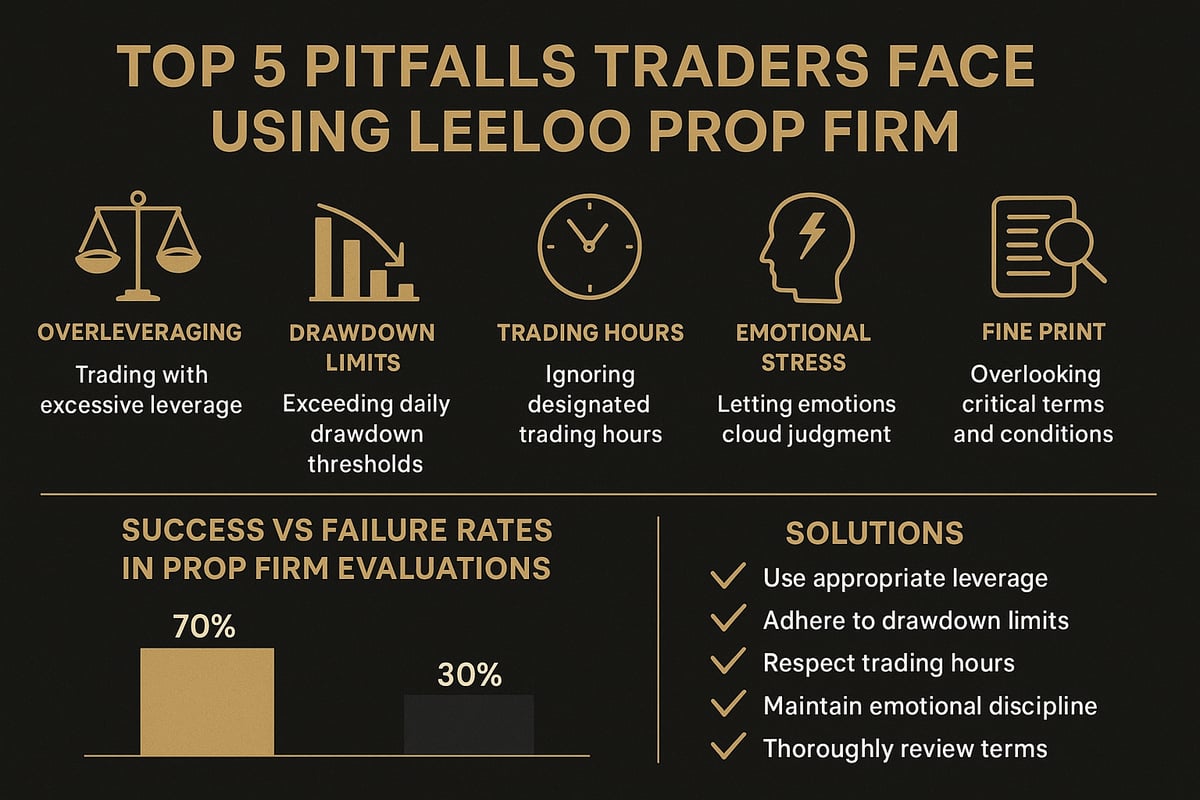

Common Pitfalls and How to Avoid Them with Leeloo

Even experienced traders can stumble when navigating the leeloo prop firm evaluation process. Understanding frequent mistakes is essential for protecting your capital and boosting your chances of success.

1. Overleveraging and Ignoring Risk Rules

Many traders fail the leeloo prop firm challenge by risking too much per trade. Overleveraging can quickly breach daily loss limits or trailing drawdowns. To avoid this, always calculate your position size before each trade. Stick to a maximum risk threshold—typically 1-2 percent of your account per trade.

Pitfall | Solution |

|---|---|

Overleveraging | Size positions conservatively |

Ignoring risk | Set stop-losses every trade |

Building discipline around risk is non-negotiable for passing any leeloo prop firm evaluation.

2. Misunderstanding Trailing Drawdown and Daily Loss Limits

Leeloo prop firm’s rules on trailing drawdown and daily loss can be confusing. A common mistake is failing to track how realized and unrealized profits affect your account’s drawdown level. Violating these limits results in instant disqualification. Review the Understanding Prop Firm Trading Rules for clarity on how these metrics work.

Set up alerts within your trading platform to warn you when you approach these thresholds. Always end your day before hitting the maximum allowed loss.

3. Skipping Minimum Trading Days or Violating Trading Hours

Some traders rush through the evaluation, skipping required minimum trading days or trading outside of allowed hours. Leeloo prop firm enforces these rules strictly. Failing to meet minimum day requirements or trading during restricted periods will void your progress.

Keep a calendar or checklist to log each valid trading day. Double-check the allowed trading hours for your account type before entering any position.

4. Emotional Trading: Revenge Trades and Chasing Losses

Emotional responses like revenge trading or chasing losses are frequent causes of failure. After a losing streak, it’s tempting to increase trade size or break your plan. This behavior almost always backfires within the leeloo prop firm structure.

To counter this, take breaks after losses, review your plan, and never deviate from your predetermined rules. A solid routine and trading journal can help identify emotional triggers.

5. Not Reading the Fine Print

Hidden fees, reset charges, or recent rule changes can catch traders off guard. Leeloo prop firm updates policies periodically, so always read the latest terms before starting a challenge. Monitor emails and dashboard notifications for announcements.

Case Study: Learning from a Failed Evaluation

Consider a trader who passed the profit target in eight days but ignored the trailing drawdown. On day nine, an oversized position wiped out previous gains, triggering disqualification. The lesson: consistent adherence to every leeloo prop firm rule is essential, not just hitting profit goals.

Industry Statistics

Industry data shows that roughly 80 percent of traders fail their first prop firm evaluation. Most failures result from overleveraging or misunderstanding rules, not from a lack of trading skill.

Key Takeaways

Respect risk management and loss limits.

Understand all rules before trading.

Maintain emotional discipline.

Track trading days and hours carefully.

Stay updated on policies and fees.

Mastering these basics will keep you on track in the leeloo prop firm journey.

Leeloo vs. Other Top Prop Firms: How Does It Stack Up in 2026?

Selecting the right prop trading partner is crucial for every trader’s journey. The landscape in 2026 is more competitive than ever, and understanding where the leeloo prop firm stands against giants like FTMO and Topstep can be the difference between average and exceptional results.

Comparing Leeloo to Leading Competitors

Let’s break down how leeloo prop firm compares to other top prop firms in 2026. The most significant differences lie in account models, rules, and profit splits. Here’s a quick overview:

Feature | Leeloo Prop Firm | FTMO | Topstep | Others |

|---|---|---|---|---|

Account Types | Evaluation, Express, Funded | Standard, Swing | Combine, Pro | Varies |

Profit Split | 80/20, up to 90/10 | 80/20 | Up to 90/10 | Varies |

Payout Speed | Weekly/Monthly | Bi-weekly | Weekly | Varies |

Platforms | NinjaTrader, Rithmic | MetaTrader, cTrader | Tradovate, TSTrader | Varies |

Minimum Days | 10 (Eval) | 10 | 15 | Varies |

Drawdown | Trailing | Static | Trailing | Varies |

The leeloo prop firm stands out for its flexible account types and rapid funding. Its Express Model in 2026 offers a streamlined path to funding, something not all competitors provide. Profit splits are highly competitive, with traders able to unlock up to 90 percent under certain conditions. For a deep dive into the specifics of Leeloo’s profit-sharing approach, see Leeloo Trading's Profit Split Structure.

A recent trader survey shows that leeloo prop firm appeals to those seeking both speed and flexibility. However, FTMO remains popular for its platform variety, while Topstep’s educational resources attract newer traders.

Unique Advantages and Drawbacks of Leeloo

What makes leeloo prop firm unique in 2026? For one, its streamlined onboarding and fast funding set it apart. Many traders highlight the responsive customer service and the simplicity of resets and express passes. The ability to choose between evaluation and express challenges lets you match your trading style to the right path.

On the flip side, leeloo prop firm does have some limitations. Platform support is narrower compared to FTMO, mainly focusing on NinjaTrader and Rithmic. Regional payout restrictions may apply, and the 30 percent consistency rule for withdrawals can catch new traders off guard. Payout schedules, while fast, require careful planning to avoid delays.

User testimonials from 2026 consistently praise leeloo prop firm’s transparency and community support. However, some note that understanding the finer details of withdrawal processes is essential. For more on payout rules, see Profit Payout Policies for Traders.

Choosing the Best Prop Firm for Your Trading Goals

How do you decide if leeloo prop firm is your ideal match? Start by mapping your trading style and goals to each firm’s offerings. If you value speed, direct support, and clear rules, Leeloo may be the right fit. For those who need a broader platform selection, FTMO could be better.

Use this checklist when evaluating prop firms in 2026:

Does the firm’s account structure suit your preferred trading style?

Are the profit splits and payout schedules attractive and transparent?

Do the trading rules align with your risk management approach?

Is the platform supported and stable for your strategies?

Are there hidden fees, reset charges, or withdrawal restrictions?

Ultimately, the best prop firm is the one that complements your strengths, supports your growth, and aligns with your long-term trading vision. Take the time to compare, ask questions, and choose the leeloo prop firm if its unique features resonate with your needs.

Advanced Tips and Resources for Leeloo Traders

Unlocking the full potential of your leeloo prop firm experience in 2026 requires more than just passing the evaluation. To build long-term trading success, you must leverage the right resources, technology, and community support. Let’s explore advanced strategies to help you thrive with leeloo prop firm now and in the future.

Leveraging Community and Support Networks

A strong community can make a significant difference for leeloo prop firm traders. Engaging with dedicated forums, mentorship programs, and peer groups provides valuable feedback and accountability.

Join official leeloo prop firm forums to connect with experienced traders.

Participate in mentorship programs for personalized guidance.

Share trade ideas and review performance with peers.

Many traders report higher evaluation pass rates when they collaborate within the leeloo prop firm community. The support network helps you stay motivated, learn from mistakes, and celebrate milestones together.

Automation, Analytics, and Technology in 2026

The trading landscape is rapidly evolving, and leveraging automation tools is now essential for consistent results at leeloo prop firm. Integrate trading bots, custom scripts, and advanced analytics to streamline your process.

Use automated trade management to maintain discipline.

Analyze performance with real-time dashboards and data visualizations.

Test strategies in simulation before applying them to your leeloo prop firm account.

Success stories in 2026 highlight traders who used automation to reduce emotional bias and improve consistency. Technology integration gives you an edge in the competitive world of the leeloo prop firm.

Continuing Education and Skill Development

Continuous learning is crucial for sustained success with leeloo prop firm. Take advantage of top-rated courses, webinars, and educational resources designed for prop traders.

Attend live webinars focused on risk management and strategy.

Enroll in online courses covering advanced trading techniques.

Participate in workshops offered by leeloo prop firm partners.

Investing in your education not only sharpens your skills but also keeps you updated on industry best practices. Many traders credit their growth at leeloo prop firm to ongoing skill development and structured learning paths.

Staying Updated on Leeloo’s Rules and Promotions

Leeloo prop firm frequently updates its rules, fee structures, and special offers. Staying informed is essential to maximize your profits and avoid compliance issues.

Regularly review official announcements for rule changes and new promos.

Monitor fee updates to ensure your trading plan remains cost-effective.

Take advantage of limited-time offers to boost your leeloo prop firm account.

Understanding the latest payout procedures is also vital. For example, the Leeloo Trading's Withdrawal and Payout Rules provide essential insights into withdrawal timelines and consistency requirements. Staying proactive helps you adapt quickly and seize new opportunities at leeloo prop firm.

Building a Long-Term Prop Trading Career

A sustainable trading career with leeloo prop firm extends beyond the initial funding phase. Develop a growth roadmap that includes diversification and multi-firm strategies.

Set long-term goals for scaling your leeloo prop firm account.

Explore opportunities to manage personal or client capital alongside prop trading.

Consider joining multiple firms to spread risk and increase earning potential.

Successful traders often transition from leeloo prop firm to broader roles in asset management or independent trading. By building on your prop firm experience, you can create a resilient and rewarding trading career that adapts to the evolving financial landscape.

Now that you have a clear roadmap for mastering Leeloo’s structure, maximizing your performance, and avoiding common pitfalls, the next step is putting this knowledge into practice. By following proven strategies and leveraging the evaluation tools and support networks we discussed, you’re already on the path toward real trading success in 2026. If you’re ready to take the leap, start building your skills in a simulated environment and work toward instant funding with up to a 95 percent profit split. Let’s turn your trading ambitions into real results—Get Funded.